Disclaimer: This blog article was written by an AdvancedMD partner. The views and opinions expressed in this article are those of the author(s) and do not necessarily reflect the official policy or position of AdvancedMD.

This article written by Michael Brody, DPM, CEO Registry Clearinghouse, is a MIPS update for Florida doctors.

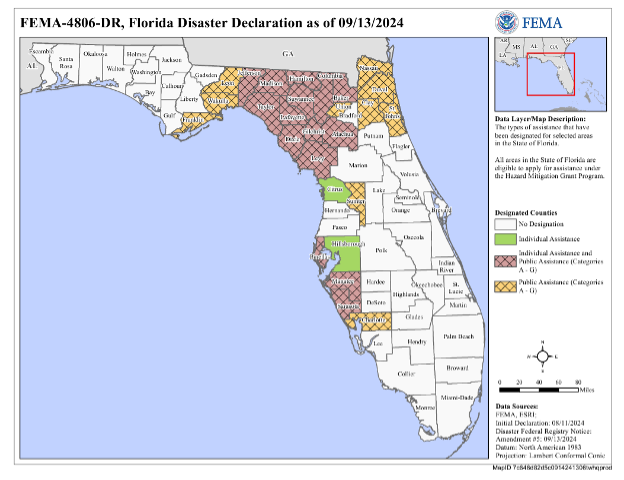

In response to Hurricane Debby, as identified by both the Health and Human Services (HHS) Public Health Emergency (PHE) declaration (Florida) and Federal Emergency Management Agency (FEMA) disaster declaration (DR-4806-FL), the Centers for Medicare & Medicaid Services (CMS) has determined that the MIPS automatic EUC policy will apply to MIPS eligible clinicians in designated affected counties of Florida.

MIPS eligible clinicians in these areas will be automatically identified and have all 4 performance categories reweighted to 0% during the data submission period for the 2024 performance period (January 2 to March 31, 2025). This will result in a score equal to the performance threshold, and they’ll receive a neutral payment adjustment for the 2026 MIPS payment year.

However, if MIPS eligible clinicians in these areas submit data on 2 or more performance categories, they’ll be scored on those performance categories and receive a 2026 MIPS payment adjustment based on their 2024 MIPS final score.

NOTE: The MIPS automatic EUC policy doesn’t apply to MIPS eligible clinicians participating in MIPS as a group, subgroup, virtual group, or Alternative Payment Model (APM) Entity. However, groups, virtual groups, and APM Entities can request reweighting through the EUC Exception application. Subgroups will inherit any reweighting approved for their affiliated group; they can’t request reweighting independent of their affiliated group’s status.

For More Information

Please reference the MIPS EUC Exception section on the Quality Payment Program Exception Applications webpage and review the 2024 MIPS Automatic EUC Policy Fact Sheet (PDF, 352KB).

A map of areas impacted by the Florida Disaster Declaration of 09/13 is below:

If you have any questions, call the QPP helpdesk to determine if you are impacted by this automatic exemption. If you need assistance with MIPS pleaser reach out to Registry Clearinghouse at

(631) 996 9222